No Will, No Plan, Big Problems: What Happens If Your Parents Don’t Have an Estate Plan?

Talking to your parents about estate planning might not be high on your to-do list—but it should be. It’s an uncomfortable conversation, sure.

No one likes to think about what happens after they’re gone. But avoiding it now could leave you and your family in a world of stress, confusion, and financial mess down the road.

If your parents don’t have an estate plan, here’s what could happen—and why it’s so important to encourage them to take action now.

The Costly Legal Battle No One Wants

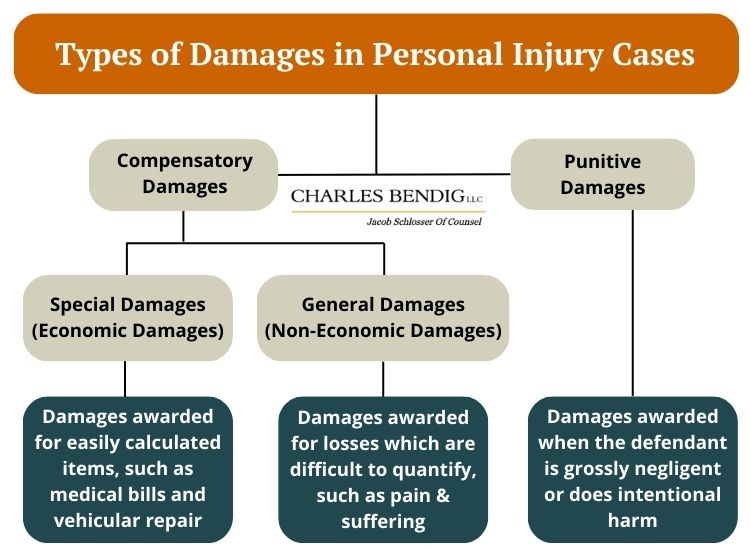

Without a will or estate plan, your parents’ assets don’t just automatically transfer to you or your siblings. Instead, everything gets tied up in probate—a long, expensive, and public legal process where the court decides who gets what.

Probate can take months, sometimes even years, and the legal fees can eat into whatever inheritance your family was expecting. Worse yet, if there are disagreements among family members (which happens more often than you’d think), it can turn into a full-blown legal battle, costing everyone time, money, and peace of mind.

The State Decides Who Gets What

When there’s no estate plan, the government steps in. Laws known as intestacy laws determine how assets are divided, and they don’t always align with what your parents might have wanted.

For example, if your parents are remarried or have stepchildren, things can get complicated fast. Certain loved ones they might have wanted to include—such as grandchildren, a longtime partner, or a close friend—could be left out entirely.

On the flip side, assets could end up in the hands of estranged relatives simply because the law says so.

The Emotional Toll on Family

Grieving a loss is hard enough without adding legal and financial stress to the mix. Families without a clear estate plan often face unnecessary tension, resentment, and arguments. Siblings may disagree about who should get what, or whether a house should be sold.

Estate planning isn’t just about money—it’s about protecting family relationships and ensuring your loved ones can focus on healing, not fighting.

Healthcare and Final Wishes? Also Up in the Air

An estate plan isn’t just about assets; it includes decisions about healthcare and final wishes. Without documents like a healthcare directive or power of attorney, critical medical decisions could be left to doctors—or to family members who may not know what your parents truly wanted.

Similarly, funeral arrangements can become a point of conflict or confusion. Having a plan in place removes the guesswork and ensures that your parents’ wishes are honored.

How to Start the Conversation

So, how do you bring this up without it turning into an awkward or defensive discussion? Here are a few tips:

- Make it about them. Emphasize that having an estate plan protects their wishes and their legacy, rather than making it about what you or your siblings want.

- Share a story. If you know someone who went through a tough probate situation, use that as an example of why planning ahead is important.

- Start with something small. Instead of diving right into wills and trusts, begin by discussing healthcare decisions or who they would want to make choices if they couldn’t.

- Offer to help. Finding an estate planning attorney, setting up a meeting, or even just gathering paperwork can feel overwhelming. Let them know you’re there to support them. (We offer free consultations. Chuck Bendig is known for his calming nature. He will make them feel at ease. Schedule a consultation today.)

Now Is the Time

An estate plan isn’t just for the wealthy, and it’s not something to “get around to later.” It’s a crucial step in making sure your parents’ wishes are honored, their assets are protected, and your family avoids unnecessary stress and hardship.

Encouraging your parents to put a plan in place now is one of the most loving things you can do for them—and for your entire family. If they’re ready to start, give us a call. We will guide them through the process and ensure everything is handled correctly.

A little planning today can prevent big problems tomorrow—and that’s a conversation worth having.